The Penny is Going Away. Now What?

We know the end of penny production changes change: should it change your pricing too?

December 3, 2025

The U.S. Mint pressed its final penny on November 12, 2025, ending 233 years of production. The decision made economic sense—each penny cost 3.69 cents to produce, creating an annual loss of $85 million to taxpayers. But for retailers, the timing was abrupt. Unlike Canada's planned, multi-year phase-out with government guidance, American businesses got a sudden announcement and no clear direction on how to handle cash transactions.

Retailers scrambled to figure out rounding rules. Some rounded down to benefit customers. Others rounded to the nearest nickel. A few just asked for exact change and hoped for the best. But beneath the operational confusion sat a more interesting question: if you can't use $4.99 anymore for cash transactions, what should you charge instead?

The obvious answer seems to be $4.95—preserve that psychological pricing trick where odd numbers feel cheaper. But here's a better question: should you be using pricing tricks at all?

The 99-Cent Menu Was Already Dead

I guess we can finally admit it—the 99-cent menu is gone. Well, it's been gone actually, for over a decade. McDonald's officially killed its Dollar Menu on November 4, 2013, and the story of why reveals everything wrong with pricing based on psychological gimmicks rather than value.

The Dollar Menu launched in 2002 during the tech-bubble recession and drove impressive sales growth. But franchisees were slowly suffocating. "It's pretty hard to make any money on a $1 double cheeseburger," one franchisee noted. When beef prices rose 69% over a decade, franchisees couldn't raise prices without destroying the Dollar Menu concept. Worse, the $1 anchor made customers unwilling to pay $4 for a Quarter Pounder.

McDonald's moved away from dollar pricing and toward value-based pricing—focusing on their actual value proposition of convenience and consistency. The result? Franchisee cash flow increased dramatically over the following years.

Turns out customers valued McDonald's at more than rock-bottom prices suggested.

The Problem With Psychological Pricing

There's a cottage industry of pricing consultants who will tell you about charm pricing (.99 endings), anchoring effects, and decoy pricing. The classic research looked compelling—early studies showed charm pricing increased sales by 24-35%.

But here's what those consultants won't tell you: the most recent research tells a very different story.

A 2022 study examining nearly 5,000 purchasing decisions found no significant effect from .99 pricing. A 2023 meta-analysis of 69 studies with over 40,000 participants concluded that effects are "considerably smaller (or even nonexistent)" than earlier research suggested. The effectiveness also varies wildly—charm pricing works for discount products and impulse purchases, but actually backfires for luxury brands. Apple's iPhone is more attractive at $1,000 than $999.

Professor Elie Ofek at Harvard Business School summed it up: "Most retailers apply charm pricing to some degree, so it's not providing much advantage to any particular companies, yet businesses still feel the need to use it." It's become a competitive necessity that provides no competitive advantage.

There's a darker problem too: trust erosion. Customers increasingly recognize these pricing schemes as manipulation. For subscription businesses or any model requiring long-term relationships, pricing consultancy Paddle warns that "utilizing pricing tactics may damage the trust" required for recurring revenue.

Small Businesses Don't Have Time for Tricks

More importantly, these tactics miss the point for small businesses. You're not in business because you're clever at psychological manipulation. You're in business because you create value for customers that they can't get elsewhere.

This is where small businesses have a genuine advantage. The Underdog Principles—positioning, proximity, and purpose—give you tools that big businesses can't replicate. Your proximity to customers means you understand their specific needs in ways that corporate data analytics never will. You know which customers need rush service, who values convenience over cost, and which problems are worth paying to solve.

That proximity should drive your pricing strategy. Not tricks, not competitor matching, not cost-plus formulas. Value.

The B-P-C Framework: A Better Way to Think About Pricing

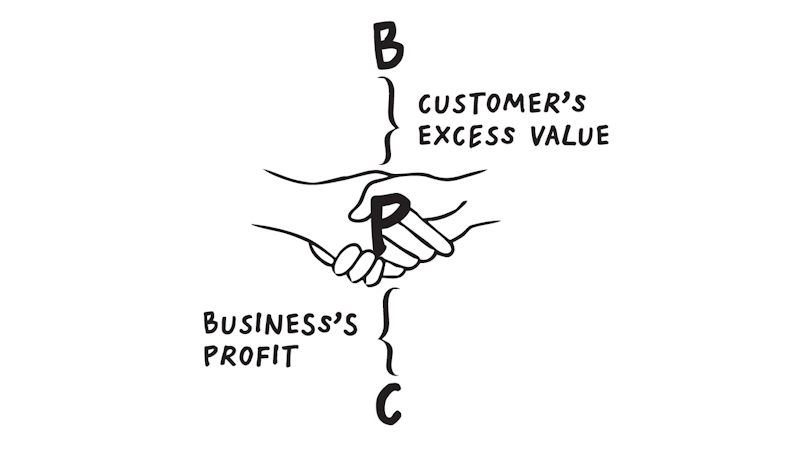

When you're thinking about what to charge for your product or service, there are really only three numbers that matter:

B = The Benefit your customer receives

P = The Price you charge

C = Your Cost to deliver it

For any transaction to work, two things must be true:

- Your price must be higher than your cost (or you go out of business)

- Your price must be lower than the benefit to the customer (or they won't buy)

The space between your cost and the customer's benefit is where strategy lives. Where you decide how much value to capture versus how much to share with customers.

Positioning Defines Your Value

Here's the critical insight: your positioning—what makes you unique—is what creates that benefit number. Maybe you're the only contractor in town who specializes in historic renovations. Maybe you're the café that's open at 6am when everyone else opens at 8. Maybe you're the consultant who actually returns calls within an hour. Maybe you're simply the closest option, saving your customer 30 minutes of driving.

Your uniqueness might be in your offering, your location, your availability, or even just in who you are and how you work. Whatever it is, that differentiation creates value for certain customers. The question is: how much?

Think about that $4 bottle of water at a concert versus 50 cents at the grocery store. The positioning is different—one is convenient when you're thirsty and captive, the other requires you to shop and carry it yourself. The cost barely changes, but the benefit to the customer is wildly different. Same water, different positioning, completely different value.

For small businesses, this is where proximity gives you an enormous advantage. You know your customers well enough to understand what they actually value. Not what surveys say. Not what data suggests. What your specific customers in their specific situations need and will pay for.

Putting a Dollar Value on Your Uniqueness

The hard part is quantifying it. What's the dollar value of being the only plumber who shows up on weekends? What's it worth to a customer to work with someone who understands their industry? What's the value of saving them a 30-minute drive?

You need to put real numbers to these questions. Not guesses—actual dollar values based on what it would cost customers to go without your service, use an alternative, or solve the problem themselves.

A rush job isn't just "worth more"—it might be worth the customer's ability to meet a deadline that saves them a $10,000 contract. Being local isn't just convenient—it might save them 90 minutes of driving, which at their billing rate equals $200. Having expertise isn't just nice—it might help them avoid a $5,000 mistake.

The benefit (B) isn't what you think your work is worth. It's what your customer's situation makes it worth to them.

The Best Pricing Shares Value

Here's what many small business owners get wrong: they think if they create $10,000 in value and it costs them $2,000 to deliver, they should charge $10,000. That's mathematically possible, but it's terrible strategy.

The value you create is B minus C—the difference between the benefit to your customer and your cost to deliver. In this example, you've created $8,000 in value. The strategic question is: how much of that $8,000 should you capture through your price, and how much should you share with your customer?

If you price at $9,000, you capture $7,000 and your customer gets $1,000 in excess value. If you price at $6,000, you capture $4,000 and your customer gets $4,000 in excess value. Both are profitable. Both are fair. But they send very different signals and attract very different customers.

The best pricing strategies deliberately share value with customers. Maybe you charge premium rates but still leave significant value on the table, which builds loyalty and generates referrals. Maybe you share more value with long-term customers than one-time clients. Maybe you capture more value from customers who need rush service, where the benefit is highest.

The key is making these decisions consciously. When you understand the full value you create—when you know both B and C—you can decide strategically where to set P. You're not guessing. You're not copying competitors. You're making a deliberate choice about how to share the value your positioning creates.

How to Apply This to Your Business

Start with your positioning. What makes you different? Write it down specifically: "I'm the only X in Y area." "I offer Z that competitors don't." "I have expertise in A that matters for customers dealing with B."

Next, put dollar values to that differentiation. What would it cost customers to go without this? What's the alternative worth? What problem does this solve? Talk to customers. Listen for phrases like "I chose you because..." or "It's worth it to me because..."

Then calculate your true costs—not just materials and direct labor, but everything. Your time, overhead, opportunity cost, the invisible expenses you ignore.

Now you have the framework: You know C (your real costs) and you have a range for B (the value to different customers). Where should P fall?

Look at your current pricing. Are you capturing appropriate value for rush work, expert advice, or convenience? Are you pricing the same for customers who get dramatically different benefits?

The goal isn't to maximize every transaction—it's to consciously decide how to share the value your positioning creates. When you understand B and C, you can set P strategically rather than by guesswork.

What Now?

The penny's elimination forced retailers to ask "what now?" for their pricing. But that's the wrong question. The right question is "what value?"

What value do you actually create for customers? What are they really paying for when they choose you over alternatives? What makes your solution worth more than your costs?

Answer those questions, and the pricing becomes clearer. You don't need psychological tricks or fancy formulas. You need to understand the benefit you provide, know your true costs, and make conscious decisions about where to price in between.

The B-P-C framework gives you a simple way to think through these questions for every product, service, and customer segment. It won't tell you exactly what number to charge—that's still your strategic decision. But it will help you make that decision based on value rather than guesswork.

Take an hour this week to work through the framework for your core offerings. Calculate your true costs. Estimate the benefit to different customer segments. Consider where your current pricing falls and whether it reflects the value you're creating.

The penny is gone, but that's just spare change. The real opportunity is to rethink how you approach pricing altogether—and build a more profitable business in the process.

Copyright 2025

Sri Kaza